Why do the Maine non-profit electric coops charge less than the for-profit T&Ds?

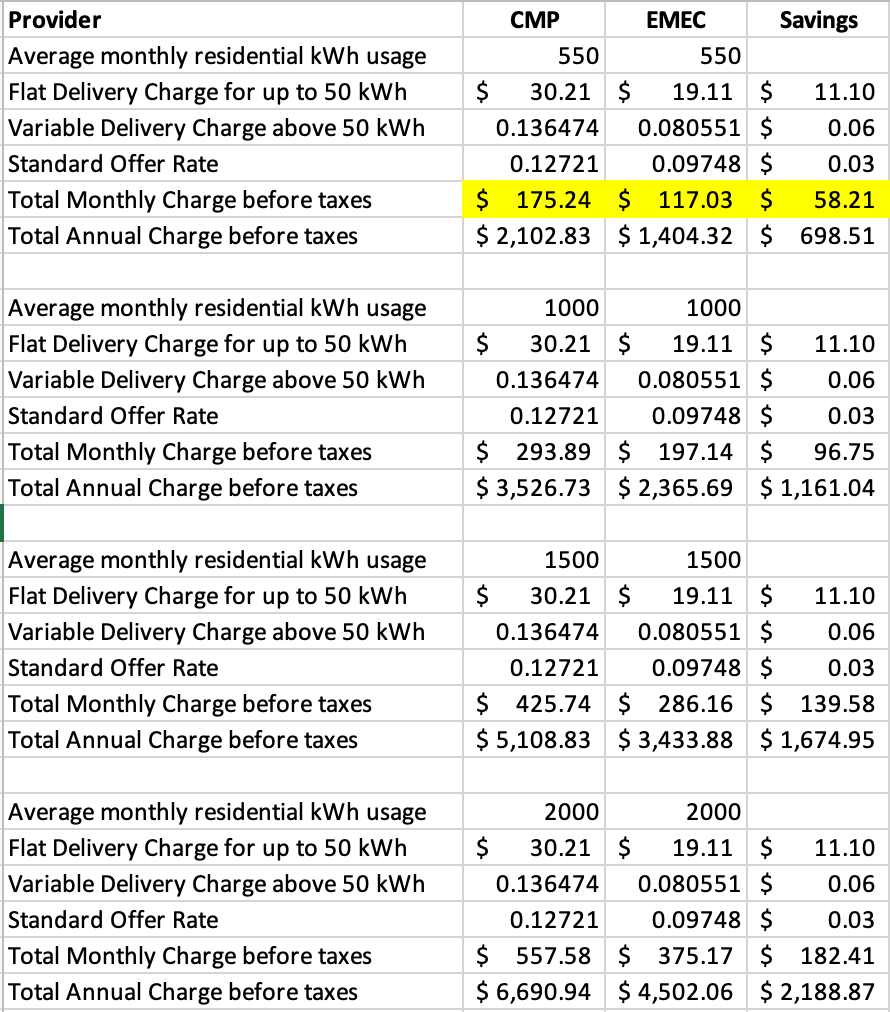

$117 per month vs $175, on average

Published below is an email written by Steve Ingalls, a remarkable energy cost researcher (he is independent of course, and not paid by anyone for doing this sort of work). He noticed that the Maine non-profit electric coops have lower prices that the big T&Ds. Substantially.

These are the questions to be asking your reps. The email was addressed to Dan Burgess, who is the acting commissioner of the Maine Department of Energy Resources. The spreadsheet numbers are published at the end of the post.

Also at the end of the post are the service areas of the T&Ds mentioned. Bolds are my emphasis.

Hi Dan,

Thank you for offering the Factors Driving Electricity Costs webinar yesterday. You may recall that I asked the following question:

“Can you please speak to the differences in the T&D costs and supply costs between some of the Maine cooperatives and the investor owned utilities (e.g. Eastern Maine Electric Coop and CMP)?” The Brattle Group answered that they had not looked at the consumer-owned utilities in their analysis but that the consumer-owned utilities and investor-owned utilities would face some of the same issues related to the cost of purchasing new equipment and the supply costs for electricity.

Given that I was asking this question in a chat box, I wasn’t able to quickly ask a follow-on question to clarify why I was asking this question. I recently took a look at what a hypothetical residential ratepayer, using the applicable standard offer rate, in the EMEC territory and CMP territory, would pay assuming each used 550 kWh of electricity in a given month. I selected 550 kWh as it is the current rough average usage of a ratepayer in these two territories. I selected EMEC as it is the largest consumer owned utility in the State and a member of a larger national entity known as Touchstone Energy Cooperatives. I selected CMP as I am located in their territory, and they are the largest investor-owned utility in the State and a part of a larger national and international entity. What I found is illustrated in the attached Excel spreadsheet. What you will see is that the EMEC ratepayer would have paid a total of $117.03 and the CMP ratepayer $175.24 in that given month. These amounts are before sales tax. In the same table I also included what if scenarios of 1,000, 1,500, and 2,000 kWh of usage. I also included an annualized total which is simply taking the one-month difference and multiplying by 12 months. As kWh usage is expected to increase in the future, due in part to beneficial electrification efforts, I would expect that the 550 kWh usage average will increase and that the cost delta between these two territories will expand accordingly.

For me, this raises two fundamental questions:

Why are CMP ratepayers paying so much more for the same electrons as compared to the EMEC ratepayer?

What can be done to bring the CMP ratepayer cost more in line with the EMEC ratepayer?

Some things that come to my mind that may lead toward an answer to these questions are:

Are any of these cost differences related to EMEC being a part of NMISA and CMP a part of ISO-NE? [Editor’s note: See this post on ISO-NE] If so, and if being a part of NMISA was found to be less expensive, what would it look like for the entirety of Maine to be under NMISA rather than ISO-NE?

What is driving the T&D portion of the rate difference? CMP has often stated that part of what drives their T&D costs are related to Maine being the most heavily forested State in the country and with many areas that they serve being very rural, creating large geographic areas to maintain vegetation and equipment with fewer ratepayers. However, EMEC experiences similar characteristics, so there seems to be more to it than the heavily forested and rural characteristics that should be explored. Also, on this subject is the question of how does CMP service reliability performance compare to EMEC? Does the higher T&D cost in the CMP territory reflect a higher service reliability performance level as compared to EMEC? If not, why not?

EMEC is a consumer-owned non-profit entity and CMP is an investor-owned for-profit entity. Is the investor-owned model adding to the cost CMP ratepayers are paying that are not being added to the consumer-owned model that EMEC ratepayers are paying? If so, then a) how much more is it adding to the investor-owned ratepayers cost and what added benefits are derived and b) should we consider what it would look like for the entirety of Maine to be operated under a consumer-owned utilities model, such as EMEC concept?

What is driving the supply portion of the rate difference? The Maine PUC negotiates the standard offer price for CMP residential ratepayers while EMEC appears (I could be wrong) to negotiate the standard offer price for their residential ratepayers. CMP’s standard offer rate is set for a one-year term and for 2026 includes a mix of New Brunswick Energy Marketing, which is a subsidiary of New Brunswick Power (25%), Constellation Energy Commodities Group (25%) and Next Era Energy Marketing (50%). EMEC standard offer rate is currently set for three years and for 2026 - 2028 is from New Brunswick Power Generation Corp. Given the significantly lower load of EMEC vs CMP, my initial expectation would be that a standard offer rate bidder would be more aggressive with lower pricing in the CMP territory vs the EMEC territory. Since that does not appear to be the case, a question then becomes whether the three-year commitment that EMEC is willing to take on is resulting in a lower standard offer price, as compared to the Maine PUC one-year standard offer price for CMP? And if the consensus is that natural gas prices are going to continue to increase, which the Brattle Group suggests, then would it be advantageous for the Maine PUC to be soliciting multi-year duration standard offer price bids as a part of their bid solicitation process?

I realize that some of my questions may raise political issues, however I truly believe we owe it to all Maine ratepayers to take a close look at what I am asking to a) determine the answers and b) determine whether any of the answers will help to reduce ratepayer costs in the investor-owned territories. I realize there are many other potential tools in the toolbox that the EUT committee, DOER, EMT, OPA and PUC are all looking at to help lower ratepayer costs, and I appreciate that. I hope that the DOER will consider adding what I am bringing up to that toolbox of things to look at.

Thanks,

Steve Ingalls

Stetson

Cc’ing Senator Mark Lawrence, Representative Steve Foster and OPA Heather Sanborn