What percent of your electric bill is NEB?

Another very short post.

It’s legislative season in Maine and these posts are very short, covering one small topic per day.

Here is the tension:

The environmental groups state that Net Energy Billing (NEB) makes up only 4% of Maine electric bills, and the increase of 60% or more over the past year is due to the volatile prices in the natural gas market.

The statement about NEB representing only 4% of bills relies on a few factors:

It only looks at residential bills

It uses numbers from 2023 and earlier, when NEB costs were about 45% of what they are now

It ignores the fact that consumers indirectly pay the costs of commercial electric bills either through decreased earning or increased costs of goods and services.

My estimate is that NEB comprises 14.4% of current electric bills. Read on to see the formula.

All quotes below are from the Feb 27 Testimony (download here -click on Energy, Utilities, Technology and then 2-27-2025)

NRCM: “Natural gas increased average residential bills by $60 a month between 2021 and 2023…Storm recovery cost CMP customers $220 million in 2024, adding $10 a month to household bills… NEB comprises 4% of bills, or $7”

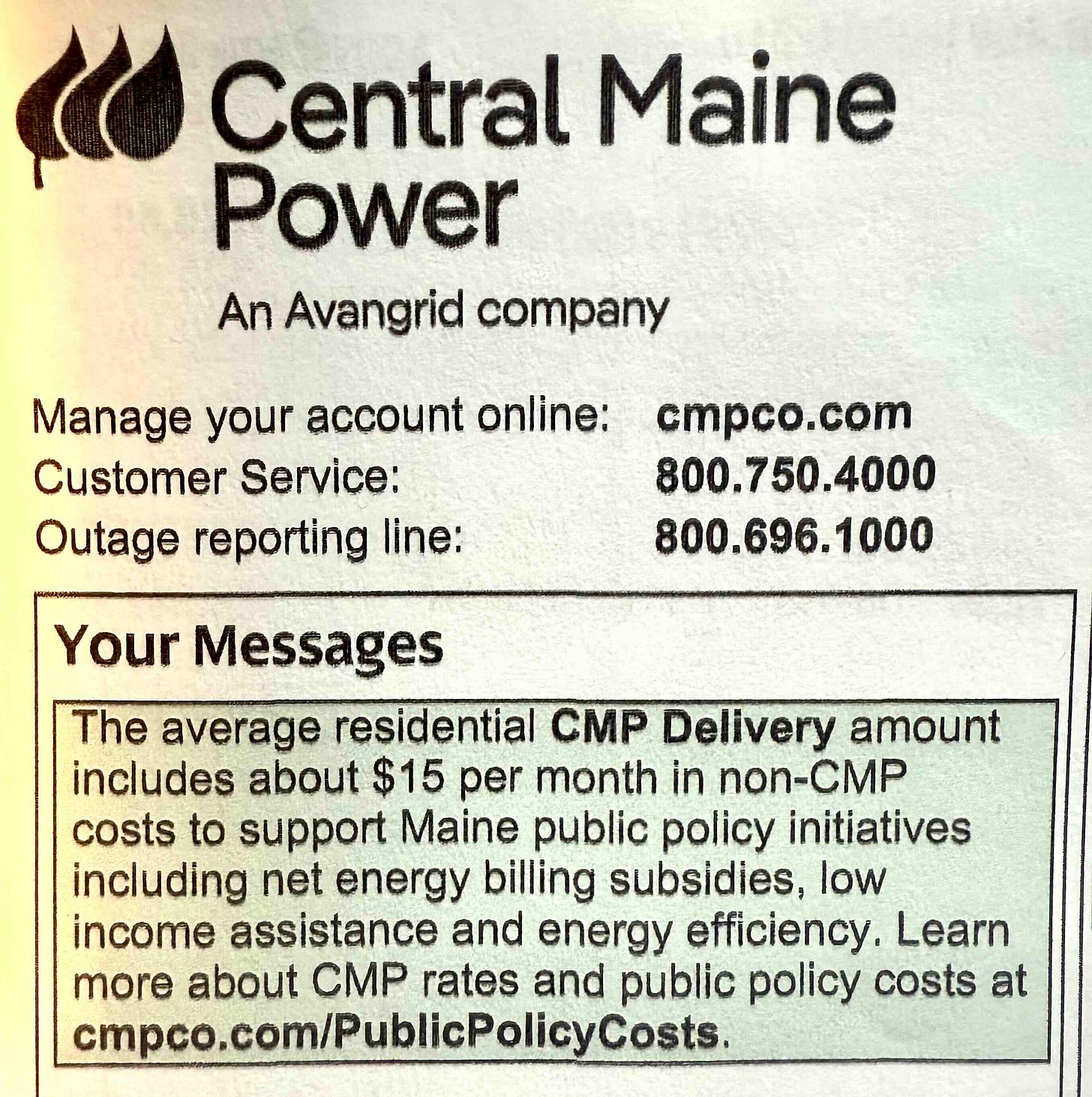

(Pointing out that the NRCM testimony, given on 2/27/25, must have been using residential bills from prior to the rate change July of 2024. Residential bills now come with a $15/month public policy charge.)

Sierra Club: “We encourage the Committee to remember January of 2023, when Mainers living in CMP’s service area saw their supply rates increase by nearly 50% per kWh, due exclusively to instability in the natural gas market caused by the war in Ukraine. Homegrown distributed renewable energy does not come with the same volatility.”

“Maine Audubon is a strong supporter of renewable energy development, including solar. Rapid deployment of new renewable energy resources is critical to reducing our reliance on fossil fuels and avoiding the worst impacts of climate change—the leading threat to Maine wildlife and wildlife habitat, the conservation of which is central to Maine Audubon’s mission.”

CLF: “The total annual cost of the NEB program for 2023 was $130.76 million, while the total benefits were more than $160 million.”

Like many, your electric bill might have increased by some enormous amount last year. I have visibility onto one MGS-Secondary bill which went from an average of 12 or 13 cents per kWh all years 2020-2024, and then jumped to 19 cents per kWh over the past 6 months.

I don’t have access to any plain vanilla (non NEB) residential bills in Maine, but like all of us, I have access to the publicly available stipulation agreement from docket 2024-00137.

This important document compiles ALL the Stranded Costs across all ratepayers in Maine.

Residential bills are directly recognized by voters - and thus increases are the most politicized - but voters are indirectly impacted by the increased cost of goods and services if commercial electric bills increase. Because it is using data from last quarter, the Stranded Costs in the stipulation agreement total up to $182 million.

We have had Stranded Costs for decades, but they have jumped in the past years due to NEB. Most of that $182 million is due to NEB, and will soon be $240 million, according to the OPA.

Now the math is simple. Is $182 million (or $240 million) equal to 4% of the electricity bills in Maine?

We could find that out by getting total revenue for CMP and Versant and adding them together.

Find the CMP financials here. 2024 financials are not complete, but they are averaging $312 million per quarter. Let’s guess they end the year at $1.2 billion. And yes, that is up substantially over the prior year. However Maine is also encouraging beneficial electrification, - i.e. increased use of electricity.

Versant financials are harder to find. (I’m expecting they are in rate negotiation dockets, but I haven’t found them) Based on the stipulation agreement, Versant appears to be 30% the size of CMP, which would put their yearly revenue around $416 million.

$1250 million - estimated CMP 2024 yearly revenues

$416 million - estimated Versant 2024 yearly revenue

=$1.666 billion.

Of which, $240 million in NEB costs is 14.4%.

Tell me, do you see the math differently?