$100,000,000 appraisal

In 2012 Maine reviewed a plan to bury 176 miles of High Voltage DC next to the highway.

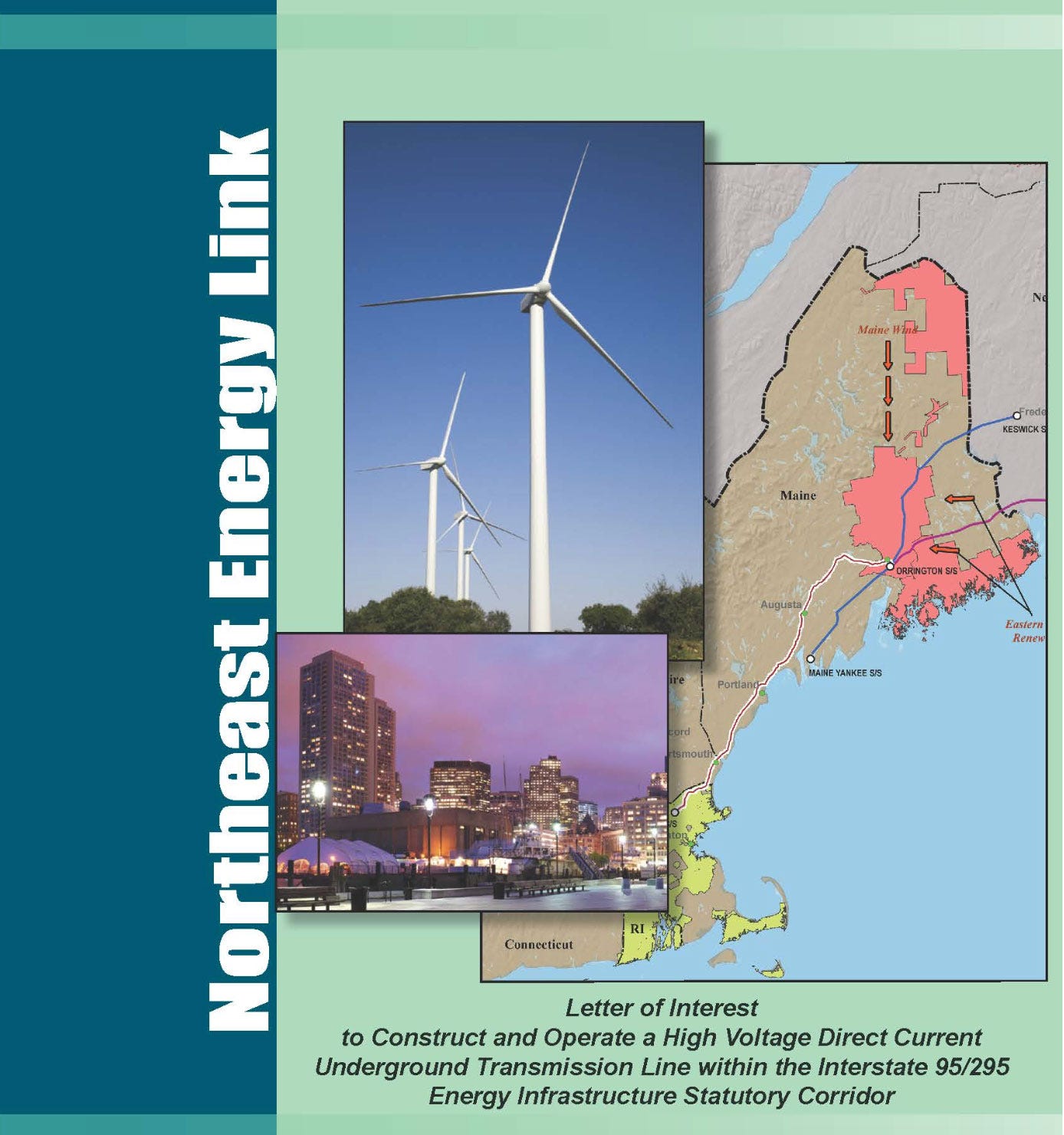

In October 2012 Bangor Hydro (now Versant) wrote a formal letter of interest to construct an HVDC buried line along Interstate 95/295, in order to transmit energy from Northern Maine and Canada into southern New England as part of meeting renewable energy goals.

In 2014, the Governor’s Energy Office (GEO) put forward a formal RFP for an appraisal of the use of the Department of Transportation highway right-of-way (ROW), now calling it an “Energy Infrastructure Corridor.”

In 2015, a 101 page appraisal with hundreds of pages of Appendix was provide to the GEO by George E. Sansoucy Appraisers. To someone who has been following the Northern Maine Transmission line procurement, this appraisal is fascinating reading.

The short version: in 2012, Maine was planning to be first of its kind in the country to put together an Energy Infrastructure Corridor for buried HVDC, in service of renewable energy goals.

In 2023, as readers of this substack know, no such thing exists. Why was the project dropped?

But, the Letter of Interest and the appraisal confirm some fascinating facts:

Projected construction cost of $2 billion- for the entire line, which extended into Mass. ($2.7 billion in today’s dollars)

Maine portion of the line projected at $1.24 billion in the 2015 appraisal

50 foot wide construction corridor, 30 foot wide permanent easement

176 mile corridor in Maine along sections of 95 and 295

Use of the far-eastern shoulder edge of the right of way (the highway is 200 feet to a quarter of a mile in width)

$100 million appraisal for 35 years minimum right-of-way (ROW)

totaling 650 acres of permanent right-of-way (i.e. $154k per acre)

line losses of HVDC along 227 miles expected at 5.9%, whereas comparable length HVAC line losses would be 11.2% (you pay for that!)

Converter stations cost $200 million, back then. Now, the lack of availability of converter stations is the primary reason utilities appear to not want to use HVDC.

Appraisal used several methods for arriving at the $100 million appraisal:

The appraisal also includes some interesting history of Northern Pass (the failed transmission line in NH that only required 32 miles of new ROW)

Based on extracting sales prices from the New Hampshire County Registry, telephone interviews with sellers by George E. Sansoucy, P.E., LLC, and route mapping observations, the following table indicates the total purchase price to date of $40,953,599, total miles to date of 32.25 and a total cost per mile of $1,299,979.

(page 73 Sansoucy Appraisal Jan 1 2015)

For those of you into the financing of transmission, there’s a whole section of the appraisal (page 87+) which covers it. FERC sets allowable rates of return:

In addition to the return of the investment and on the investment, the owner of the property is required to pay income taxes on the amount of taxable income, the figure represented by the return on the company’s net book. In ordinary real estate valuation, income taxes are an owner cost and not part of the capitalization rate.41 However, with regulated utility property, the regulators also add into electric rates additional charges to the ratepayers to reimburse the utility for the income taxes it theoretically incurs on this return. This results in ratepayers reimbursing the company at the full state, local, and federal rates on the earnings on the remaining book cost. Finally, in addition to the cash flow streams discussed in this paragraph, the regulators also increase cash flow from the ratepayers by allowing rates to include an amount representing working capital for the utility. For Maine, if the Corridor value becomes a fixed payment and is not depreciated or amortized, the earnings on the Corridor cost will be constant.

….

(Regarding Northern Pass:)

The equity portion of the $1,090,000,000 investment is reimbursed (without depreciation) at 14.618% per year. Figure 12 provides the revenue requirement worksheet for Northern Pass. However, in section 2, revenue requirements, it shows that the owners expect more from the ratepayers in New England than the return on equity; they expect the return on long term debt, federal income taxes, state income taxes, the depreciation expense, the municipal tax expense, the operation and maintenance expense, administrative expenses, and general expenses. In the case of Northern Pass, anticipated to be in service 1/1/2016, the total annual return is $186,675,688 ($219,175,688-$32,500,000)43 on a plant investment of $1,090,394,500, or approximately 17 cents on the dollar per year.

(page 87-88 Sansoucy Appraisal Jan 1 2015)

Am I reading this right? FERC allows a 17% ROI per year?

Here are the documents:

Letter of Interest

Appraisal